Featured

Salary Sacrifice Pension Example

Salary Sacrifice Pension Example. For example, if an employee is taking part in a salary sacrifice pension scheme, their contribution is taken from their salary before ni is levied. Cuts in earnings between the earnings threshold and the upper earnings limit (between £190 and £967 a week in 2022/23) normally produce a ni saving for the employee of.

Under the government’s pension auto enrolment rules, for example, this would typically be 5%. On a salary of £25,000 (£20,000 after tax), suppose you currently put 5% or £1,250 (£1,000 + £250 tax relief at 20%) into your pension. The employee then pays 20% tax and 13.25% nics on the £1,000 (£332.50).

Include Salary Sacrifice Scheme [Not Company Pension, Use Below) Salary Sacrifice:

Zac is wondering if he has any scope to make a further payment into his pension this year, having maximised his contributions in previous years. The salary sacrifice calculator for 2022/23 monthly tax calculations. On a salary of £25,000 (£20,000 after tax), suppose you currently put 5% or £1,250 (£1,000 + £250 tax relief at 20%) into your pension.

It Is Simple To Follow And Shows How You Can Benefit From Doing.

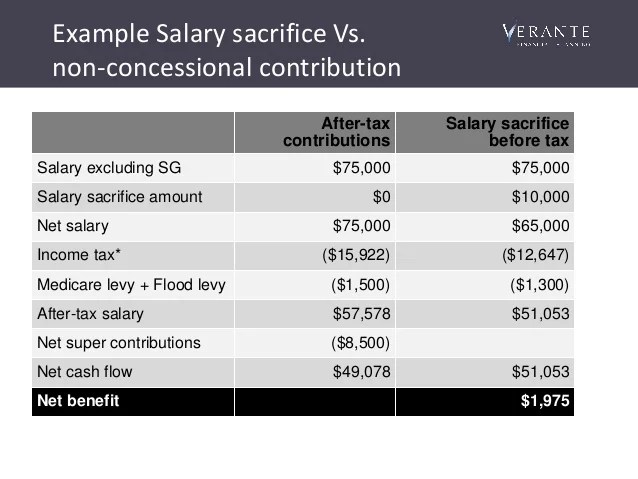

For example, alex has a salary of £30,000 a year and contributes. A salary sacrifice pension scheme usually requires more work to set up, but is made attractive by the national insurance savings available. Let’s use an example with numbers to understand how salary sacrifice works.

John Is Paid An Annual Salary Of £20,000.

It is a tax efficient way for you to save money on your. Salary sacrifice pension tax relief usually the personal contributions you make to your pension are eligible for tax relief from the government. Salary sacrifice and pensions epen15a ng08050 03/2022 salary sacrifice (also known as salary exchange, smart pensions and smart pay) can help you provide some of your employees.

She Paid 5% Of Her Earnings Into Her Workplace.

Under the employer’s registered workplace pension scheme, pension. Cuts in earnings between the earnings threshold and the upper earnings limit (between £190 and £967 a week in 2022/23) normally produce a ni saving for the employee of. For example, if an employee is taking part in a salary sacrifice pension scheme, their contribution is taken from their salary before ni is levied.

Salary Sacrifice Lets You Make Contributions To Your Pension And Helps To Save On National Insurance At The Same Time.

Let’s say your starting salary. The employee then pays 20% tax and 13.25% nics on the £1,000 (£332.50). He pays £1,200 (gross) into his.

Popular Posts

True Or False Lsd Is An Example Of A Hallucinogen

- Get link

- X

- Other Apps

Comments

Post a Comment